3 E-Commerce Stocks That Could

American e-commerce huge Amazon.com Inc. (AMZN, Money) has been one of individuals shares that turned a lot of smaller-time investors into millionaires and manufactured those who were presently abundant even extra rich. More than the previous decade, the stock has accomplished cumulative progress of 1,560% with a compound once-a-year growth fee of 31%. The 20-year CAGR is even greater at 35%.

Generally when businesses get this big, they reach a amount wherever even a significant get in earnings can represent a reasonably compact share gain. As a consequence, shares stagnated in 2019 in advance of becoming catapulted better by business expansion from the Covid-19 pandemic.

The stock now appears to have arrived at a plateau yet again, investing in a somewhat limited selection from late 2020 by way of the existing working day. Small of an additional worldwide disaster that leads to a sharp enhance in e-commerce need, it appears not likely that Amazon will enjoy these types of a sturdy bull operate once more.

That is not to say that Amazon won’t continue on growing. The e-commerce pattern is probably to proceed accelerating, and analysts forecast that Amazon’s earnings for each share will double concerning 2021 and 2023. At a rate-earnings ratio of 68.23, Amazon is rather valued in accordance to the GuruFocus Price chart. As extended as the company’s valuation metrics continue being the identical, the inventory could obtain a CAGR of about 50% around the future couple of years if it meets analysts’ anticipations.

Having said that, making use of the same valuation method for other e-commerce providers final results in some fascinating findings. In particular, e-commerce favorites that operate in countries exactly where on the web purchasing is not nevertheless as well-liked as it is in the U.S. feel to supply the most desirable growth options.

JD.com

JD.com Inc. (JD, Economic), also recognised as Jingdong and formerly named 360obtain, is one particular of the two most significant enterprise-to-shopper e-commerce businesses in China in terms of transaction quantity and income, the other staying Alibaba’s (BABA, Economic) Tmall. The vast majority of its revenue is derived from on-line direct sales.

In comparison to Alibaba, JD’s company structure is less difficult and has improved very first-get together logistics foundations. Whilst Alibaba is concentrating on growing its lower-margin retail enterprises and its currently unprofitable cloud and electronic media segments, JD is concentrating on its high-margin very first-social gathering logistics system and its (also unprofitable at the minute) cloud business enterprise. For the reason that of its narrower target, JD also faces a lot less regulatory scrutiny than Alibaba.

JD.com has a three-year earnings for each share progress charge of 24.8% and a three-12 months Ebitda per share advancement price of 118.1%. The cost-earnings ratio of 23.11 is beneath the 10-calendar year median of 34.59. According to the GF Benefit chart, the stock is modestly overvalued.

Analysts estimate that JD.com’s earnings per share will develop from 55 cents in 2021 to $2.23 in 2023, which would be a 305% cumulative acquire. Provided the corporation fulfills analysts’ expectations and trades with related valuation metrics, it could get 152% for each yr around the up coming two yrs. If its valuation multiples were being to enhance along with sustained better progress in the long term, gains could be even extra outsized.

Having said that, JD.com’s earnings for each share have assorted drastically owing to non-recurring goods, so it could be much more precise to use earnings for every share devoid of non-recurring items. Analysts are expecting the company’s earnings with no NRI to mature from $1.22 in 2021 to $3.01 in 2023, representing the potential for 146% cumulative expansion above the following two many years, or 73% for every yr.

MercadoLibre

MercadoLibre Inc. (MELI, Monetary) is an Argentinian on line market business that operates e-commerce and on-line possibility web sites, including mercadolibre.com. It is headquartered in Buenos Aires, but is included in the U.S.

The company’s largest markets are Brazil, Argentina and Mexico. As of 2021, its website is by far the most-visited e-commerce website in all of Latin The us with an normal of 667 million regular visits. This considerably outpaces the second-most visited e-commerce web page in Latin The united states, which is none other than Amazon itself with 167 million average month to month visits.

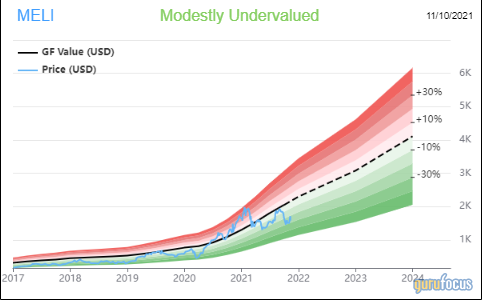

The a few-year profits for every share growth amount for MercadoLibre is 42.6%. Meanwhile, the three-yr Ebitda for each share advancement fee is 28.9%. The price tag-earnings ratio of 1,030 is higher than the 10-12 months median of 53.44. According to the GF Benefit chart, the stock is modestly undervalued.

Analysts estimate that MercadoLibre’s earnings for each share will develop from $3.45 in 2021 to $20.22 in 2023, which would be a 486% cumulative gain. Offered the enterprise fulfills analysts’ anticipations and trades with equivalent valuation metrics, it could obtain 243% per yr about the up coming two many years. If its price tag-earnings ratio have been to drop back again to the 10-calendar year median, then the stock could improve closer to 12.5% for each year, which would not be a great deal this is certainly a stock that will rely on mega-growth valuations.

The company’s advancement could be even far more impressive when getting non-recurring merchandise out of the photograph. Analysts count on MercadoLibre’s earnings per share devoid of NRI to be $3.22 in 2021 and $21.64 in 2023, representing 572% cumulative development, or 286% for every yr (14% for every calendar year if valuation multiples fall to the historical median).

Sea

Singapore-centered Sea Ltd. (SE, Monetary) is a world-wide client world wide web corporation that operates by 3 most important segments: digital entertainment (Garena), e-commerce (Shopee) and digital payments and fiscal expert services (SeaMoney).

Sea has carved out a dominant e-commerce place in Southeast Asia by leveraging the synergy of its enterprise segments. The corporation is also expanding outside of Asia, with a concentrate on the Latin The us area, where by it will compete with MercadoLibre. Though the Shopee e-commerce website nonetheless trails considerably driving MercadoLibre in conditions of website traffic with only 40.7 million common every month visits, it is fascinating to be aware that the attractiveness of its Absolutely free Fireplace sport and advertising partnership with soccer megastar Cristiano Ronaldo have aided it come to be the most-downloaded searching app in Latin The united states.

The a few-year income for every share growth amount for Sea is 65.8%. Nonetheless, the three-yr Ebitda for each share progress price is in the pink at -1.1%, given that the organization is concentrating on intense progress around profits. The corporation doesn’t have a value-earnings ratio because it is presently not financially rewarding. According to the GF Value chart, the inventory is substantially overvalued.

Analysts estimate that Sea will report a decline for each share of $2.21 in 2021. By 2023, however, they are anticipating earnings per share of 46 cents. Considering the fact that this enterprise is not profitable, we can turn to the prime line for inventory development estimates. Analysts task Sea will convey in profits of $9.8 billion in 2021, which ought to grow to $18.4 billion in 2023, symbolizing 87% cumulative advancement, or 43% calendar year in excess of 12 months.

Having said that, if Sea have been to start off turning a profit in the upcoming, it could result in the inventory to skyrocket. Amazon was not profitable for the to start with 6 decades of its publicly traded life, and neither was JD.com. MercadoLibre became profitable just after just a few years on the stock market place, but it posted internet losses from 2018 by means of 2020 as it commenced focusing on expansion again.