Philippe Laffont Shakes Things – GuruFocus.com

Philippe Laffont (Trades, Portfolio)’s Coatue Management LLC lately disclosed a new stake in Mix Labs Inc. (BLND, Fiscal), a fintech software program business providing a cloud-based platform for a range of banking products and solutions.

According to GuruFocus Serious-Time Picks, a Premium attribute, the firm obtained 11,286,100 shares of Mix Labs’ inventory on July 17, offering the keeping a 1.28% weight in the fairness portfolio. On the day of the trade, shares traded for an typical cost of $20.90.

About Coatue Management

Started in 1999 and headquartered in New York, Coatue Administration is an personnel-owned private hedge fund sponsor. It launches and manages various hedge resources for purchasers and is maybe best regarded for its tech-focused hedge fund. The business largely invests in U.S. and non-U.S. publicly traded fairness securities, but it also has small positions and investments in non-public equity and hedging marketplaces.

Main Investment Officer

Philippe Laffont (Trades, Portfolio), who launched the business immediately after leaving Tiger Administration, takes a top-down solution to inventory selecting and focuses on the details technologies sector.

Additional on Mix Labs

Mix Labs was established in 2012 and has its headquarters in San Francisco. The company’s cloud-based mostly platform powers stop-to-conclude consumer journeys for any banking merchandise, and it advertises alone as “leading the change to shopper-centric banking.”

In addition to deposit accounts and credit rating cards, the company’s goods also involve personalized financial loans, motor vehicle financial loans and a home loan lending platform servicing the home buying system for the two purchasers and creditors. It allows monetary products and services providers these kinds of as Wells Fargo & Co. (WFC, Financial) and Lennar Corp.’s (LEN, Money) home finance loan arm to process an ordinary of a lot more than $5 billion in transactions for each day.

In simple fact, many persons have previously been interacting with Mix Labs’ solutions without even knowing it. The company’s emphasis is on bringing shopper financial products this sort of as home loans and car loans into the 21st century, and it is facilitating more rapidly applications, less complicated uploads and more quickly pre-approvals.

The corporation brings in profits principally on a computer software-as-a-provider design, and it has gone public just as its most important current market, the house financial loan origination process, is purple-very hot. This has assisted it increase profits quickly, just about doubling the leading line between 2019 and 2020, though internet revenue is still in the damaging array.

Despite the seemingly good long-phrase outlook for the business, traders have bid the stock down considering the fact that its July 16 initial general public giving. To date, shares have lost 15% as investors fear about a prospective cooldown in the housing marketplace and the point that Mix Labs has nonetheless to arrive at the profitability phase.

Portfolio overview

Based on its most new filings, Coatue Management held shares of 76 typical shares valued at a complete of $25.52 billion. The top rated holdings in its portfolio were being DoorDash Inc. (Dash, Fiscal) with 6.75% of the equity portfolio, Amazon.com Inc. (AMZN, Monetary) with 5.86% and Moderna Inc. (MRNA, Fiscal) with 5.65%.

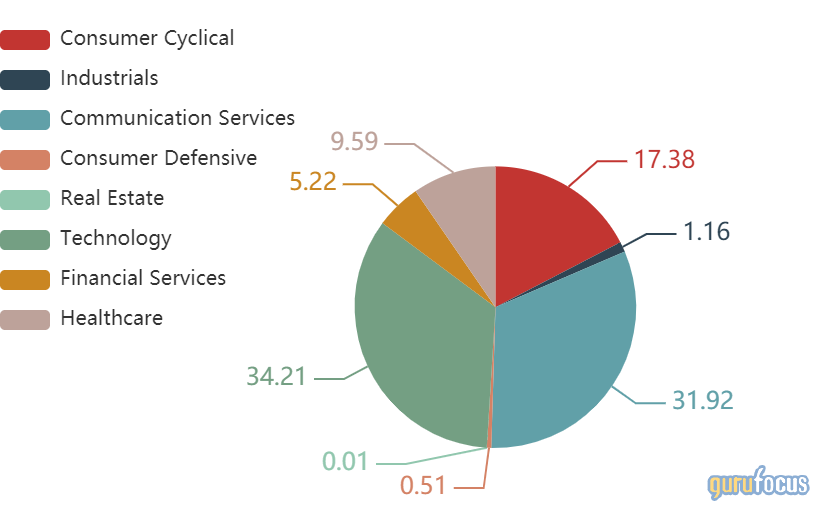

In terms of sector weighting, the agency was most invested in engineering, interaction products and services and buyer cyclical.

Laffont’s other fintech software package holdings consist of Brazilian electronic payments and enterprise fintech provider StoneCo Ltd. (STNE, Economic), American digital payments and economic providers organization Square Inc. (SQ, Economical) and Canadian e-commerce system and retail issue-of-sale procedure Shopify Inc. (Shop, Economical).