US Markets Kick Off 4th Quarte

On Friday, Berkshire Hathaway Inc. (BRK.A, Economical)(BRK.B, Economical) CEO

Warren Buffett (Trades, Portfolio)’s most loved sector indicator stood at 145.7%, down from the Sept. 1 reading of 151.6%.

Buffett’s industry indicator declined from the Sept. 1 looking at on the back of U.S. market place indexes slumping in September, with the Dow Jones Industrial Common, Nasdaq Composite Index and the Typical & Poor’s 500 index declining 4.3%, 5.3% and 4.8%, respectively.

US marketplaces get started Oct with gains

U.S. marketplaces start off October with gains pursuing Merck’s (MRK, Fiscal) new oral Covid-19 procedure announcement. The Dow shut at 34,326.46, up 482.54 points from the previous near of 33,843.92. Likewise, the Nasdaq closed at 14,566.70, up 118.12 factors, and the S&P 500 closed at 4,357.04, up 49.50 points from Thursday’s close.

Merck, just one of Berkshire’s well being treatment holdings, declared that its joint oral remedy with Ridgeback Biotherapeutics minimized the risk of hospitalization and demise by roughly 50% among Covid-19 sufferers. The firms strategy to find crisis authorization for the remedy.

Market enters October with a September decline

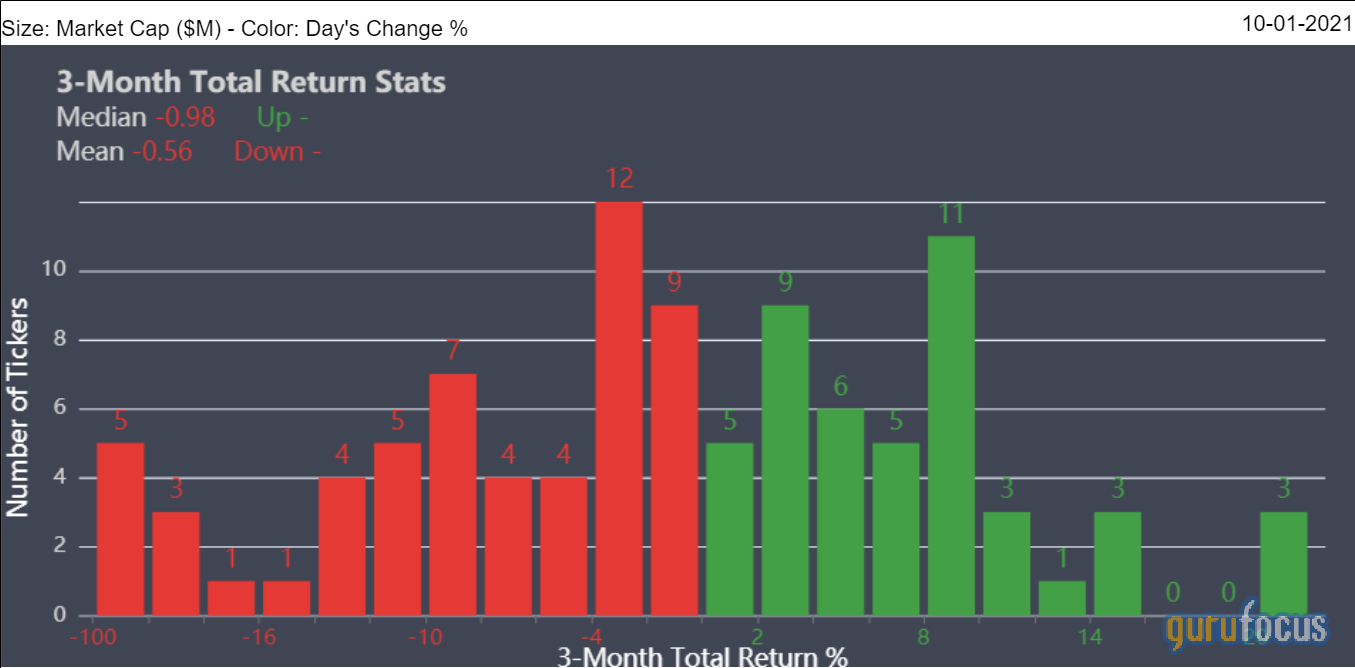

Figures 1, 2 and 3 illustrate the Aggregated Statistics Charts for the Dow, Nasdaq 100 and S&P 500 in conditions of the a few-month overall return.

Figure 1: 3-Month Whole Return for Dow Jones Industrial Common Stocks

Determine 2: 3-Thirty day period Full Return for the Nasdaq 100 Shares

Determine 3: 3-Thirty day period Full Return for S&P 500 Stocks

As the figures illustrate, the 30 shares in the Dow experienced a indicate 3-thirty day period overall return of 1.81%, with a median of 2.14%. For the S&P 500 shares, the imply a few-thirty day period complete return is -.34% with a median of -.16%.

Stocks declined throughout September as buyers grappled with inflation fears and slowing growth. Chris Hussey, a running director at Goldman Sachs Team Inc. (GS, Monetary), additional in a observe that he sees other headwinds like China, fading fiscal stimulus and provide chain bottlenecks.

Current market continues to be considerably overvalued to start out Oct

Regardless of the September decrease, the U.S. market stays noticeably overvalued based mostly on Buffett’s favorite current market indicator, with the Wilshire 5000 Full Cap Price Index trending somewhere around 1.45 instances the sum of gross domestic product or service and whole belongings of the Federal Reserve.

Based mostly on the present industry valuation degree, the implied return of the U.S. current market is -.9% for every calendar year assuming that valuations revert to the 20-year-median industry valuation level.

GuruFocus also regarded as an optimistic scenario in which valuations revert to 130% of the 20-12 months-median marketplace valuation amount and a pessimistic circumstance in which valuations revert to just 70% of the 20-12 months-median industry valuation stage. In accordance to these eventualities, the implied current market return ranges from -5% to .40%.

Also verify out: