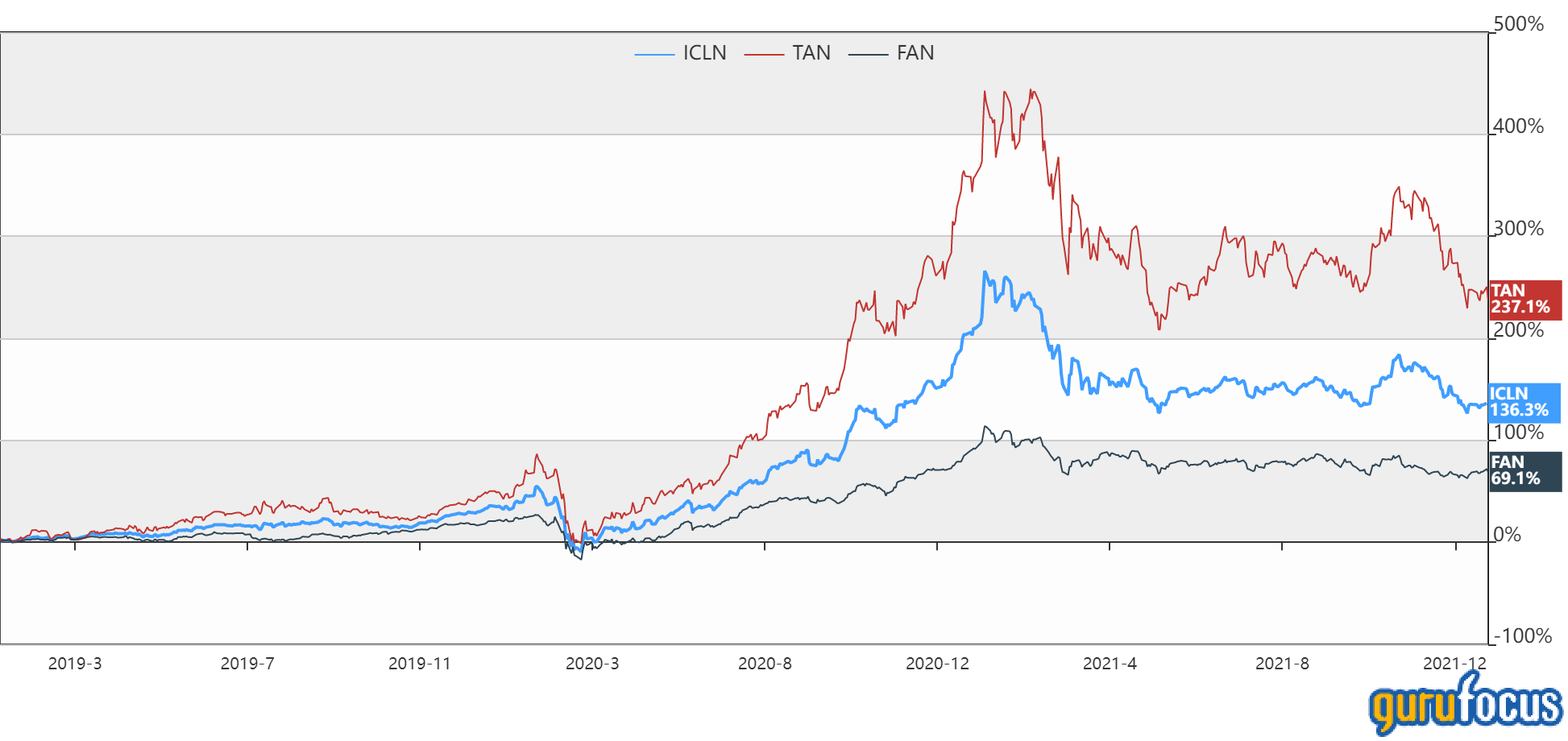

Previous yr was a tough just one for clear strength stocks as provide chain challenges blended with overvaluation worries and policy uncertainty prompted broad selloffs. The iShares S&P Global Clean up Vitality Index Fund (ICLN, Financial) ETF misplaced 25% in 2021, even though the Invesco Photo voltaic ETF (TAN, Financial) was down 26% and the Very first Believe in World wide Wind Electricity ETF (Admirer, Monetary) booked a 13% drop.

Having said that, in advance of 2021, clean up power shares had been booking sturdy gains, primarily in 2020, when a quick drop in March was followed by skyrocketing valuations as traders started to choose observe of the inevitability of fossil fuels sometime operating out and needing to be changed with clean up vitality sources.

With the correction in cleanse strength stocks seeming to have levelled out to much more affordable valuations, could even further gains be ahead for the sector as governments around the entire world maximize their investments in thoroughly clean electrical power? Let’s take a look.

Clean vitality tailwinds

As a full, world desire for energy is anticipated to enhance by 4% in 2022, according to the Worldwide Strength Agency. Nevertheless, about the very same timeframe, the quantity of vitality made from renewable energy sources is only projected to increase by about 6%. Looking at that renewables account for 30% of the complete electrical power market place share as of 2021, this signifies clean strength output is presently not increasing quickly plenty of to meet the world’s rising vitality need.

This shortfall of thoroughly clean electricity advancement means that devoid of even further investments in making out thoroughly clean electrical power infrastructure, the planet will retain rising its use of fossil fuels, accelerating the inevitable time when we will ultimately operate out of these gasoline sources.

Even putting aside the damages that fossil fuels are creating the environment, if we continue to keep burning fossil fuels at the present level (with no even further increases in each day fossil fuel usage), then the planet will operate out of fossil fuels totally by all around 2060, according to a combination of estimates compiled by Octopus Power. Which is barring any new reserves that might be uncovered, but it also excludes growth in fossil gasoline demand from customers.

Regardless, we really should run out of fossil fuels by the close of the century at the most up-to-date, and about 50% of latest acknowledged reserves are unburnable if we want to maintain worldwide warming to a “relatively safe” stage of 2 levels Celsius by 2050.

All of this suggests that governments and companies alike have to have to action up their investments in clean up power infrastructure if we want to even now have matters like electricity and autos in 50 several years. Cleanse power pledges are getting to be prevalent amid businesses, with lots of boasting that they have strategies to arrive at net zero by 2050. The U.S. governing administration, for its aspect, aims to achieve web zero emissions in its functions by 2050 (excluding armed forces).

With marketplace expansion envisioned and required for quite a few decades to appear, traders may possibly obtain it really worth their time to look at the names in this sector in depth (or commit in trade-traded cash for quick portfolio diversification), as the 2021 pullback in cleanse energy inventory charges seems to have mainly stabilized.

A single tool that investors can use to come across likely alternatives in this area is the GuruFocus All-in-1 Screener. Beneath are some of the stocks I found making use of different requirements on the screener, which slide broadly into two distinct categories: price and growth.

Value shares to view

When it will come to value, the pickings are slim amongst thoroughly clean electrical power stocks. With higher-advancement industries, investors are eager to assign sky-higher valuations to shares that they are enthusiastic about. A person require seem no farther than Tesla Inc. (TSLA, Money) for an case in point of this the pioneer in electric autos accounts for additional than 50 percent of the complete sector cap of the overall U.S. car industry, in spite of delivering nowhere in close proximity to as a lot of automobiles as the likes of Typical Motors (GM, Monetary) or Ford Motor Co (F, Fiscal).

Screening for shares that trade at a lower price to their GF Price does throw up a couple of noteworthy names, these types of as Canadian Solar Inc. (CSIQ, Fiscal), a Canadian photo voltaic module producer and photo voltaic merchandise developer. This company is increasing its earnings for every share at 12% for each calendar year, which is not too shabby, though its 3-calendar year profits per share expansion rate is only .4%. Spanish renewable energy utility operator Solaria Energia y Medio Ambiente SA (XMAD:SLR, Economic) is buying and selling beneath its GF Value, is rewarding and has major and base line growth premiums of much more than 12%.

Most undervalued cleanse power prospects show up to be outside the U.S., in countries that have invested extra in renewable vitality creation, but some value prospects may well continue to be located here. For case in point, U.S.-dependent photo voltaic energy firm First Photo voltaic Inc. (FSLR, Financial) has a value-earnings ratio of just around 20 now that its earnings have grown to be additional in line with its stock selling price.

Wind farm gear maker TPI Composites Inc. (TPIC, Economical) is normally ignored simply because it an industrial items corporation, and though its weak financials are a large danger (the Altman Z-Rating of 1.88 shows bankruptcy opportunity), the inventory is trading under its GF price. If this company can resolve its source chain problems, it may perhaps be equipped to pull alone out of sizzling h2o, but this a single will in all probability slide underneath the “too risky” classification for most individuals. I’m putting it on my watchlist to observe any new developments.

Growth shares to enjoy

Expanding the search further than benefit, there are other clean power names to take into account that could be value their better valuations due to outperforming on the progress entrance. The list of clean electricity companies that have grown each their top and base strains at double-digit costs in new a long time is a quick a single, even though, even shorter than the value record.

SolarEdge Technologies Inc. (SEDG, Money), an Israeli producer of ability optimizers, checking devices and other merchandise for photo voltaic panel arrays, is a person of the few that would make the list. This company’s exceptional mix of fast progress and a stable monetary condition has granted it a selling price-earnings ratio upwards of 100.

New Zealand’s biggest electric power producer, Meridian Electricity Ltd. (NZSE:MEL, Economical), has been generating double-digit advancement as very well, and it is even undervalued based mostly on the GF Worth Line. The condition-owned hydro-electrical electric power generator may not have a lot room for multiple growth provided its status as a state-owned utility, but it does spend a 3%-furthermore dividend and is unlikely to run out of funding provided its political worth.

In the Asia location, quick-growing renewable strength names consist of Shanghai Nenghui Technological innovation Co. Ltd. (SZSE:301046, Financial), a China-primarily based “new energy” energy generator and engineering services supplier that is developing rapid thanks to sizeable governing administration investment.

Japan’s RENOVA Inc. (TSE:9519, Financial) has found its stock undertake a impressive rise and slide, but with the top rated line expanding at a lot more than 30% per calendar year and the base line doubling that, the formation and popping of this bubble should not influence the company’s very long-phrase prospective. The rate rose to unsustainable ranges on investor optimism and plummeted again to a additional acceptable level when the company declared that it would comply with the G20’s Task Drive on Weather-related Financial Disclosure on Dec. 21, 2021.

Summary

Previously mentioned is only a area-degree seem at some of the organizations in the renewable energy sector that glimpse eye-catching centered on specified value or advancement metrics. Traders who are interested in these firms will want to carry out their possess in-depth investigation on profitability, advancement opportunity and fiscal hazards, between other variables.

The outlook for the sector as a total is attractive, and there are also several more businesses out their that may in shape your own expense conditions. For traders that are bullish on the sector but do not want the danger of selecting specific names, clean vitality ETFs can present some portfolio diversification as well.

More Stories

Building a Brand’s Reputation through Design

An overview of the different Training Methods

Hotel and Catering Review – Issue 9 2022